NAOC Divestment: Time to dismantle transaction clogs

![]()

Sopuruchi Onwuka

It has become necessary and even urgent for regulators in the industry to evolve a smooth process for implementation of the relevant sections of the Petroleum Industry Act relating to entry and exit of investors in the upstream petroleum industry where some international oil companies now feel trapped in their respective partnerships with the Nigerian National Petroleum Company (NNPC) Limited.

From Chevron to ExxonMobil and now Eni, the complaint has been the inability of the partners of the national oil company to freely recover their investments without complications that exist outside normal business transactions.

In the prevailing deal in which Oando stands the opportunity of raising its participating interest in the Eni operated NEPL/NAOC/Oando joint venture to 40 percent with nearly a billion barrel reserves outlook, the national oil company has raised a flag alleging a breach of agreement and threatening to invalidate the transaction. This objection could be genuine but it falls into mold with NNPC’s previous actions.

With more divestment deals underway, strident voices appeal to the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) to evolve efficient transaction checklist for asset acquisition deals arising from divestment of brownfield assets by international oil companies.

The two private partners in the in the NEPL/NAOC/Oando petroleum exploration and production joint venture are the latest in the line to approach the NUPRC with asset divestment and acquisition agreement for clearance.

According to separate statements by the companies, Italy’s Eni has agreed to sell its interests in the joint venture to Oando, a move that would now make the indigenous energy firm the sole partner to the Nigeria National Petroleum Company (NNPC) Limited which is represented in the JV by Nigeria Exploration and Production Limited. If the estimated $550 million deal pulls through, then a new NEPL/Oando JV would be underway.

With the acquisition of NAOC, Oando expects its inorganic reserves growth to reach 996 million barrels of oil equivalent, and significantly increase its production.

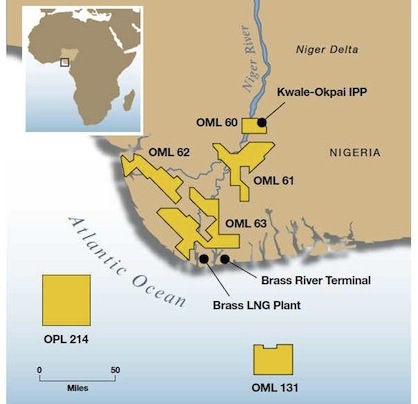

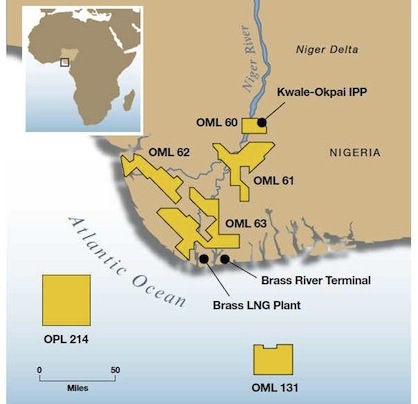

The NAOC assets under acquisition are limited to those in the operated JV, and do not include interests in the NNPC/Shell/Total/Agip JV operated by Shell which has separately put all operated JV assets on deferred auction.

All the parties in the NAOC divestment transaction are existing partners with longstanding working relationship under a joint operating agreement governing the JV. The existing relationship holds the advantage of making the transaction process smooth.

The Oracle Today reports that Oando had farmed into the JV after a momentous acquisition of the interests of ConocoPhillips in 2014, a $1.5 billion transaction that marked the total exit of the American multinational oil firm from Nigeria and transformed the erstwhile NNPC/NAOC/ConocoPhillips JV to current NEPL/NAOC/Oando JV.

The company had suffered a very long wait for a ministerial assent to the ConocoPhillips acquisition, a delay that visibly translated to huge financial losses as the prevailing oil prices which formed the basis of deal negotiation shortly began a steep plunge. The company staggered and struggled to keep afloat.

In the current deal, Oando is progressing to the minister’s office for assent. And signals of delay are already in the horizon. The NEPL has raised a flag, complaining in a formal communication to its partners that the ongoing divestment did not achieve consensus of all JV partners.

In the letter E&P/MD/0523, the NEPL expressed surprise that NAOC has assigned its entire 20 percent participating interest in oil mining leases (OMLs) 60, 61, 62 and 63 to Oando. The national oil company warned that the “purported assignment, if true,” would have far reaching contractual/legal implications “in relation to the Joint Operating Agreement (JOA) dated July 1991 governing the operations of the NAOC/NEPL/OOL Joint Venture.”

The letter signed by the Managing Director of the NEPL, Ali Muhammed Zarah, made it clear that NAOC failed to obtain a mandatory pre-divestment written consent and approval from NEPL in accordance with the JOA.

The letter quoted clauses in the JOA requiring such a consent which, as was stated, should not be unreasonably withheld by other parties in the JV. Zarah declared in the letter that the failure of NAOC to obtain full consent of partners in the JV constitutes “a grave breach,” emphasizing that the NEPL reserves the right to invalidate the divestment.

In the event that the deal pulls through, Zarah pointed out, it would not automatically confer operatorship of the joint venture to Oando until the parties reach a decision on who succeeds NAOC as operator.

“In view of the foregoing, we request NAOC’s confirmation to NEPL the authenticity or otherwise of the reported divestment to enable us to determine our next steps with regards to the management/operations of the assets,” the national oil firm demanded.

What is heartening in the NEPL reaction to the divestment deal is the limitation of its grievance to process breaches without declaring interest in acquiring the assets. This carves an easier path to navigate the crisis than in the cases of ExxonMobil and Shell which are in stickier regulatory and legal quagmire. Perhaps the key factor for NNPC’s soft stance here might be directly related to the striking similitude in the surnames of the Group Chief Executive of Oando and the President of the Federal Republic: Tinubu!

Nevertheless, the letter from NEPL does not promise the smooth and speedy process investors have demanded for access into the industry. Fears still exist that the second major divestment of assets to an indigenous company in the petroleum industry is, once again, slowing down to a regrettable stalemate over complaints from the national oil company.

The prevailing issue around the NAOC divestment falls into an evolving pattern of recent divestment deals as the international oil companies in the country begin to dispose vulnerable brownfield assets onshore a fast maturing Niger Delta basin.

The national oil company has used its preemptive rights in the past to secure choice assets for its exploration and production subsidiaries; including acquisition of the Chevron’s JV interest in OMLs 86 and 88 onshore Niger Delta.

The $1.3 billion deal in which ExxonMobil Corporation of the United States seeks to sell out all its stakes in Mobil Producing Nigeria Unlimited (MPNU) to Seplat Energy Plc has lingered since 2021 without resolution as the NNPC claims rights of preferential offer over the assets. All efforts by ExxonMobil to navigate through the NNPC road block to a waiting ministerial approval have so far failed.

Similar to the fate Oando suffered in the ConocoPhillips acquisition in 2014, Seplat is currently caught up with cost escalation in relation to the acquisition as oil prices fluctuate and local economy plunges into galloping inflation and forex illiquidity.

Thus, analysts view that matters arising from the divestment of ExxonMobil joint venture portfolio as the critical set of issues that would ultimately dominate subsequent transactions as multinational major continue to recover capital from traditional joint ventures.

Chairman of A A Holdings, Mr Austin Avuru, who had predicted mass exit of international oil firms from onshore Niger Delta as early as 2008, has consistently called for a regulatory template for managing divestments, in order to use the bownfield assets in grooming capable indigenous firms that would crew the next phase of upstream activities in the country.

He decried the long delays in concluding asset acquisition deals as the major cause of low investments, lull in field activity and fall in oil and gas production volumes.

Mr Avuru made it clear that little or no investment would flow into assets that have been marked for disposal, explaining why production decline has been steep in JV assets currently in the hands of ExxonMobil and Shell.

In casting an outlook on the petroleum industry, Mr Avuru stated that it is normal for independents to step into maturing terrains left behind by international majors to explore bypassed opportunities and optimize production.

How efficiently the asset divestment is managed, he said, is critical in capturing the full resource opportunities.

Another industry captain, Dr Emmanuel Okoroafor, stated in an interview that it is no longer an argument that Nigeria has efficient and globally qualifies indigenous industry experts. He made it clear that polices and processes must be efficient enough to enable capacity drive excellence.

A branch chairman of the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) agreed in full with Mr Avuru and also demanded the NUPRC to rapidly evolve a checklist of procedures for divestment of interests in the industry.

Such a checklist, he emphasized, must include decisions and agreements among parties on the fate of workers engaged by the companies divesting the assets. He pointed at uncertainty of the jobs of workers deployed in the divested assets.

He told our correspondent that what regulators have failed to do is capture and address the labour issues inherent in divestments until there has been disruptive agitation.

“Divestment means investment recovery. And once the company gets cash, it is no longer available for any kind of negotiation. Government should ensure that all issues bordering on severance are also decided and implemented before a fleeing investor secures a transaction.”

In our earlier report on the subject (https://oraclenews.ng/jv-divestments-nuprc-owes-new-investors-deal-guidelines/), we quoted Mr Avuru as explaining that the ongoing divestments provide inorganic growth opportunities for many indigenous independent oil companies that currently thrive on lean suboptimal assets in the upstream petroleum industry.

Whereas the Nigerian Oil and Gas Industry Content Development (NOGICD) Act of 2010 recommends preferential consideration for companies that operate in the country, the rate and frequency of licensing rounds have failed to offer new reserves to indigenous players battling rapid production decline. The situation leaves them desperate for inorganic growth through accretive asset acquisitions, mergers and farm-in arrangements.

Apart from Seplat which is obviously bullish with cash-for-asset acquisitions, other indigenous independent oil companies with proven operating capacity in the conventional terrains, including Britannia-U, Consolidated Petroleum (Conoil), Platform and a host of others are desperate for new reserves.

With limited deepwater operating and funding capacity, the best available growth opportunity for the indigenous companies remains in the divestment programmes. And many indigenous companies await emerging divestments from the nation’s traditional joint venture partners.

“Divestments will be the sustainable growth path for the indigenous companies in the immediate to long term. And how the regulators manage ownership transitions arising from the divestments would shape the future of the industry as the majors migrate to the deepwater,” Dr Okoroafor pointed out.

In sum, the national oil company and the upstream regulator must wake up to the reality of growing need and desperation of the small indigenous companies to replace waning reserves and run sustainable operations.

If the NNPC could run seamlessly with foreign firms, it can also run smoothly with indigenous firms. Constantly throwing wedges in the way of the Nigerian players is becoming an unhealthy pattern that is impacting its reputation.

Most importantly, it has been strongly canvassed that the NUPRC should rise to the evolving need for a checklist for parties in farm-out and acquisition transactions. A checklist of mandatory requirements should be made freely available for reference. This will guide such transaction through a smooth path and nip post-deal disputes in the bud.